There is no doubt that 2022 has been a tough year for the financial markets. This is what a bear market looks like. Since topping out in early January of this year, asset values have been falling across the board. Other than cash, there hasn’t been any where to hide. Stocks, bonds, real estate, even gold in this inflationary environment have declined.

Interestingly, this is the 2nd bear market we’ve had since 2020. Remember the pandemic 35% decline in March-May of 2020? That lasted all of 6 weeks. That was a bear but more like a cub. This bear is the real deal.

So where are we going?

Not trying to be profound here, but the market is going to get to wherever it is going to get to. It’s going to get there either in time measured in months or there will be a precipitant; an event that will speed up the process of getting us to where we are going to go. That’s just what it is.

So how is it going to play out this time? That’s a question that isn’t going to answer itself. The real question is, “How do you protect yourself?”

I think a smart thing to do is to make sure you have enough cash in savings, CDs, money market accounts, treasuries to get you through the next 1 ½ to 2 years. Have enough cash on hand to sleep well at night. Bear markets don’t last forever, and they are followed by bull markets. And because you don’t know when the tide will turn, I don’t think it is a good idea to sell all your securities at this time because you are concerned the market could fall further.

The other day I was talking with a very knowledgeable client and he said to me: “There are so many headwinds in the market now, I can’t see any reason at all for the market to rally from here, so that means it probably will.” And of course, since then, the market is up close to 1000 points. Go figure.

I will say this though: if an event occurs and you wake up one day with the market down big, decide now what you would do, if anything. If you say to yourself that you would sell into that panic because you think it would get worse, I’d suggest doing some selling now. Sell down to your sleep level. Conversely, if you said to yourself that you would be buying into a panic, as has many times in the past turned out to be a wise move, and you would be a buyer, then hang tight for now. Now you know what you’ll do if and when the time comes. By doing this, all the emotion is taken out of the decision. One less thing to worry about.

Last thing: you might be wondering what this item is. A couple of weeks ago, a good friend and client jokingly asked how I could fix the market. I replied, “I wish I had a magic wand that I could wave and get rid of the troubled times.” A couple of days later, my friend showed up at the office and dropped off a homemade “magic wand.” So, I’m waving it, but so far it’s had minimal impact. But the year isn’t over yet.

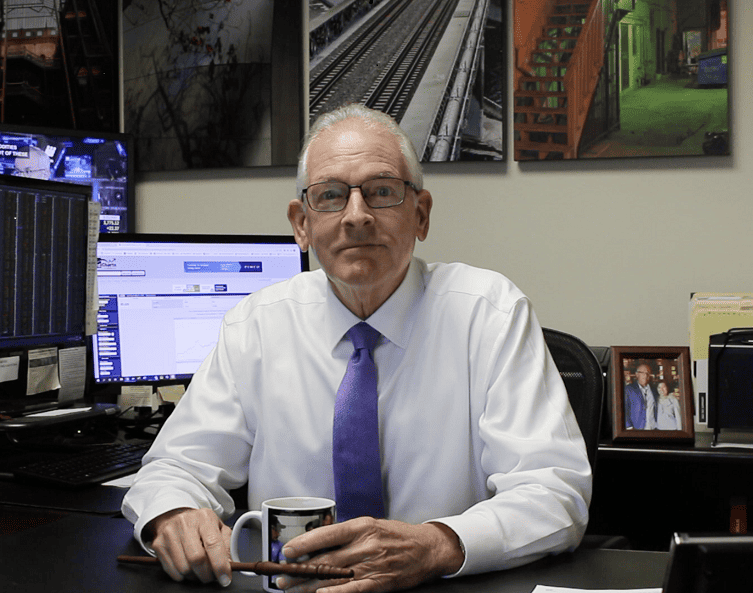

Until next time, I’m Phil Albitz.