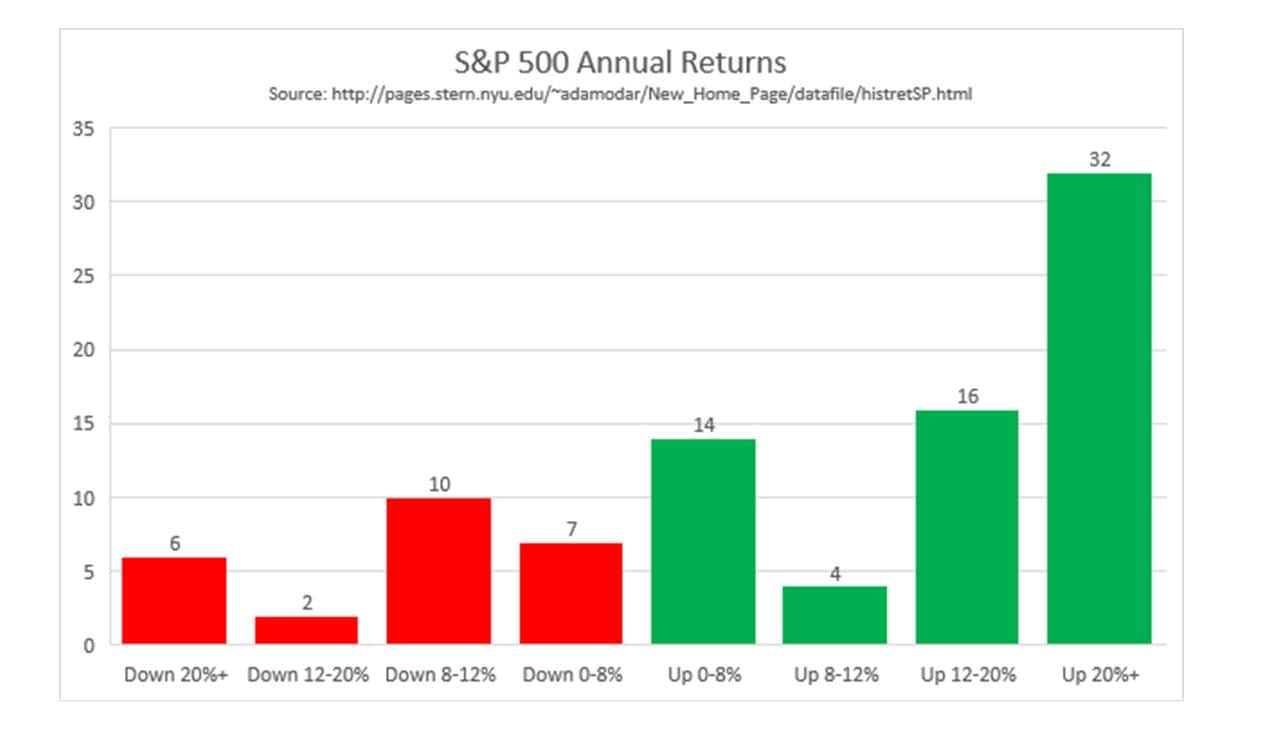

When we hear about annual long-term equity returns, quoted figures typically range between 8 and 12% depending upon the type of equities under evaluation (i.e. large cap vs. small cap, growth vs. value, foreign vs. domestic, etc.). Interestingly, the average return is typically not achieved in any given calendar year. Reviewing historical annual returns of the S&P 500 over the past 91 years (1928 – 2018), the average return is 11.3% – but there have only been four times where the calendar year return has been near it in the 8 to 12% range.

Surprisingly, historical returns exceeding 20% in a calendar year are far more common than you’d probably expect. In fact, about one-third of the time, returns have exceeded this lofty level. To really have earned the “average” return over this time period, it would have been imperative to capture the returns and remain invested during the 20%+ return years. This is easier said than done as lurking around each corner is the chance of a very bad year – there have been six years where the market declined in excess of 20%.

Determining and matching your investment horizon to your planned use of funds remains key. With the constant news cycle, keeping a long-term perspective can be challenging. When the next down year comes, remember that it is both normal and necessary in order to set the stage for future returns. On the bright side, the general market, as measured by the S&P 500, has been positive over 70% of the time during this period. Although you’re unlikely to earn an “average” return in any given year, the odds remain in favor of the long-term investor.