It is estimated that 75% of daily trading volume is the result of automated computerized trading and equity prices seem to be more volatile today than ever. However, volatility is nothing new, and if you find yourself paying too much attention to the noise of short-term price action, one simple way to minimize volatility is to “not look so much”. Keeping a long-term perspective may be cliché but remains important as an investor.

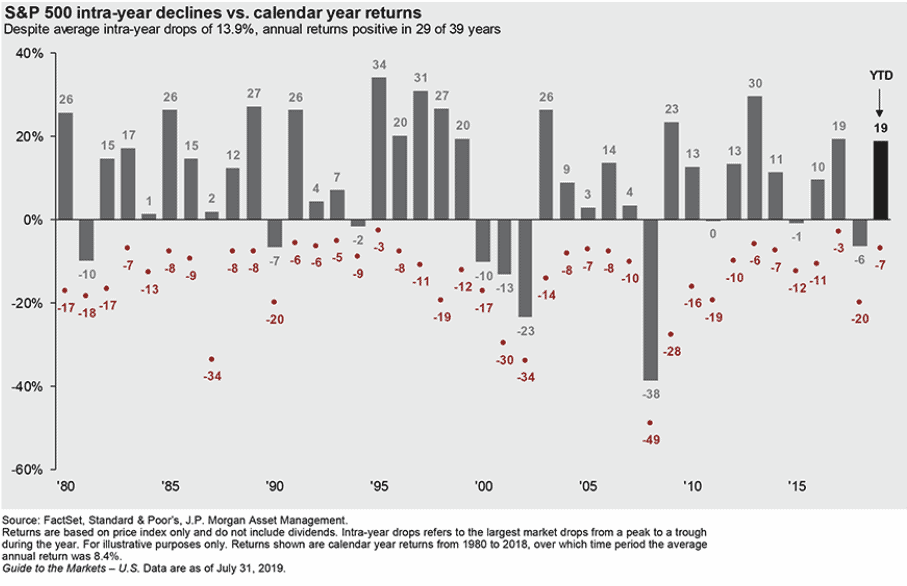

Relatively large price swings in the equity markets are normal. Since 1980, as measured by the S&P 500, more than 50% of all years have been subject to a double-digit market correction with the average intra-year decline being 13.9%. During these times, assuming you have already set aside funds for current and upcoming cash needs, you’ll want to do your best to stay calm, and remember that we don’t own equities because we like risk and volatility, but do so because they provide higher long-term returns needed to meet important financial goals.

Over the same timeframe, calendar year returns were positive over 75% of the time with the average annual return being over 8% per year. By setting and keeping proper expectations about what will likely happen to your investment’s value over a market cycle, you can better gain or keep the resolve to remain invested. History has shown that investors who can do so are well rewarded over time.