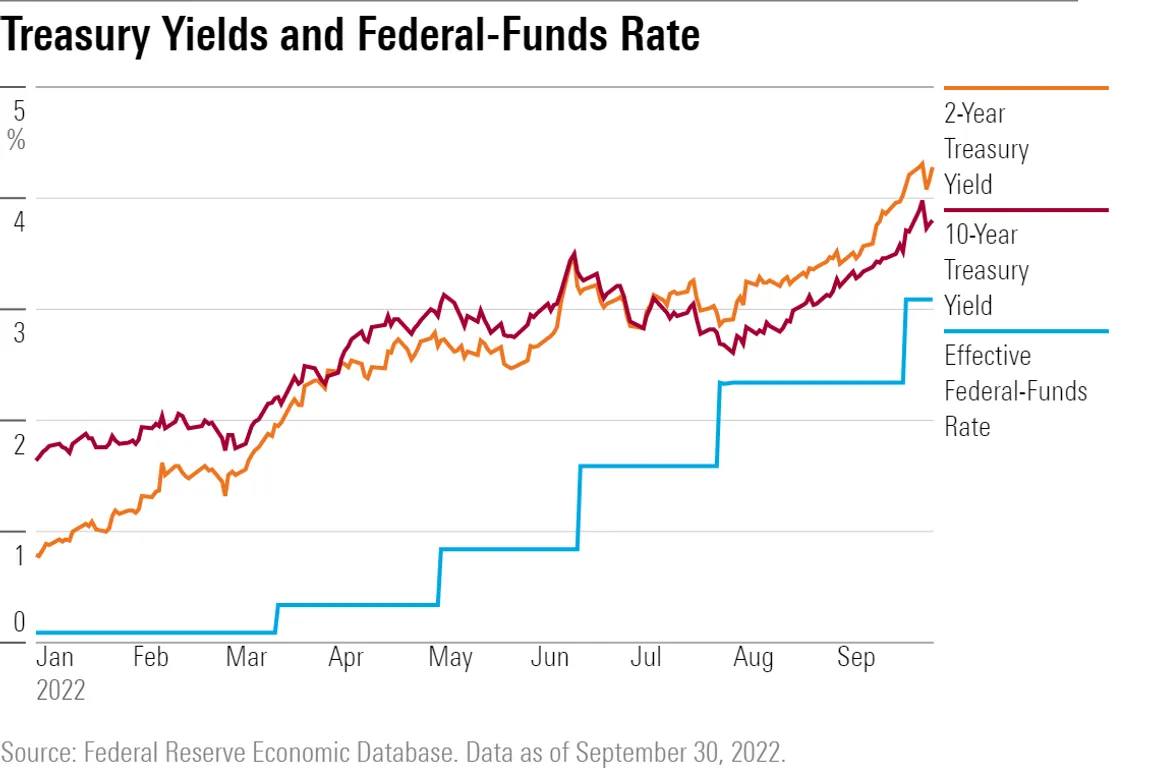

Underlying the market turmoil has been the Fed’s aggressive interest rate increases and the resulting jump in bond yields. In the third quarter, investors saw two more hikes of .75 percentage points, one in July and the other in September. The effective federal funds rate now stands at 3.00%-3.25%, its highest level since 2008. Before the Fed raised its policy rate by .75 percent in June, the Fed had not raised its policy rate by .75% in any single meeting since 1994.

At its latest meeting, the Fed signaled no signs of slowing down its hawkish stance. Fed officials’ suggested that the Fed funds rate may rise by another percentage point by the end of this year. The latest “dot plot” of Fed officials’ forecasts showed that the median expected interest rates would rise to 4.4% by the end of the year. This was a big increase from the median Fed projection of 3.4% released in June.

With this aggressive move by the Fed, US Treasuries have now become a key strategy within portfolios. Treasuries can benefit an investment portfolio with consistent interest payments and a lower risk relative to other investments.